What is a Virtual Terminal?

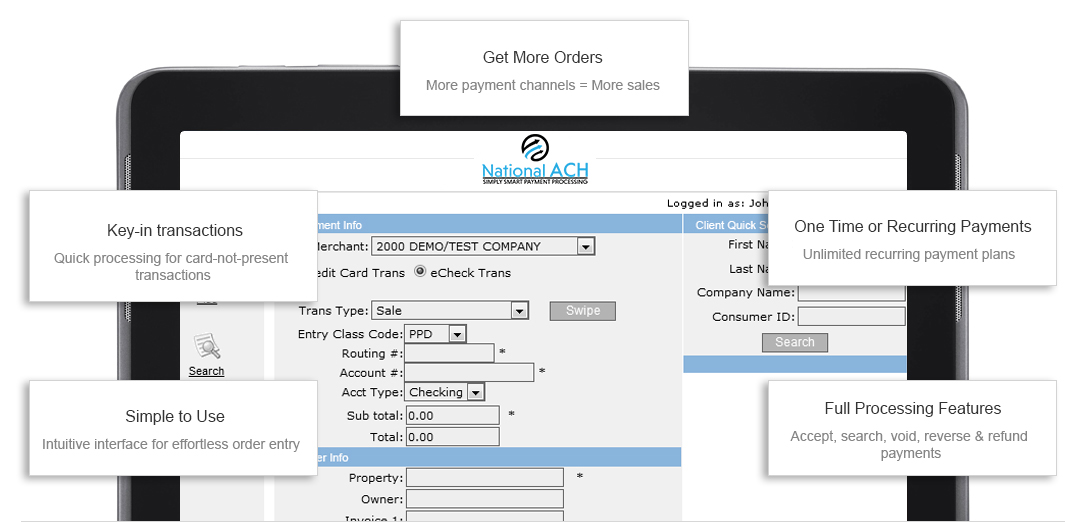

A virtual terminal is a web-based application and requires no additional software. Any computer with internet access can be used as a virtual terminal. Virtual terminal merchant accounts include unlimited virtual terminals.

A virtual terminal connects to a secure payment processing gateway. The payment gateway encrypts sensitive payment data and then transmits the information to the banking networks. Results of a transaction (approval / declined) are returned within seconds.

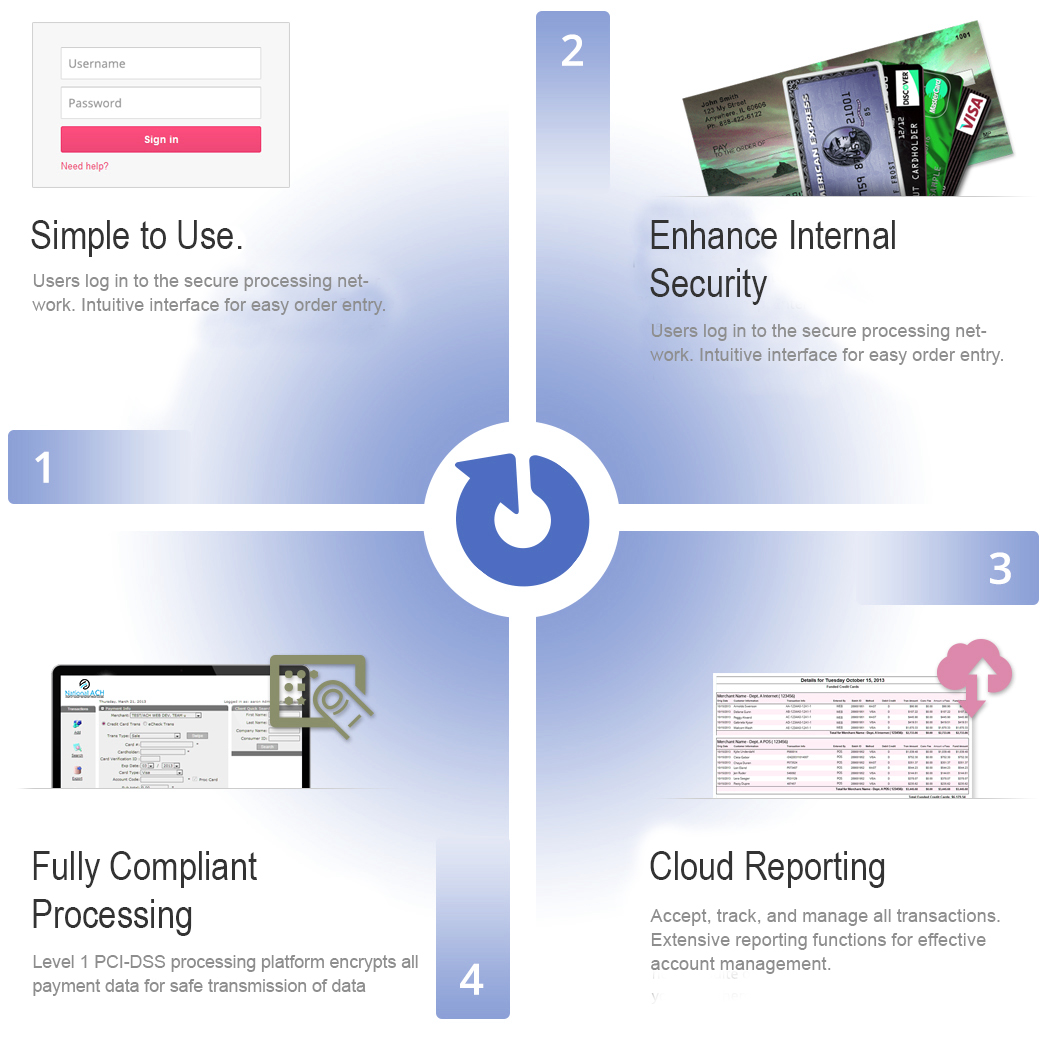

Logging into a virtual terminal is accomplished by entering a username & password. Hierarchical access to processing features gives you the ability control the functions that each user can perform. For example, management needs different functions than do customer service representatives. And your accounting or sales departments may want to view different data than your senior executive team.

Virtual terminals enhance internal security protocols by giving employees access only to the features necessary to do their jobs. You can easily track job performance of users of the virtual terminals. While safeguarding your business against temptations of internal theft or fraud.

The virtual terminal payment processing gateway is integrated with most major shopping carts, CRM, and accounting systems, eliminating development expense and speeding time to market. Rich cloud reporting for virtual payment terminals provides you all information needed to effectively manage your business.

Exchanging data between your virtual terminal merchant account and internal business systems is a breeze. Automation streamlines business operations and increases productivity.