Sell Online with Ecommerce Payments

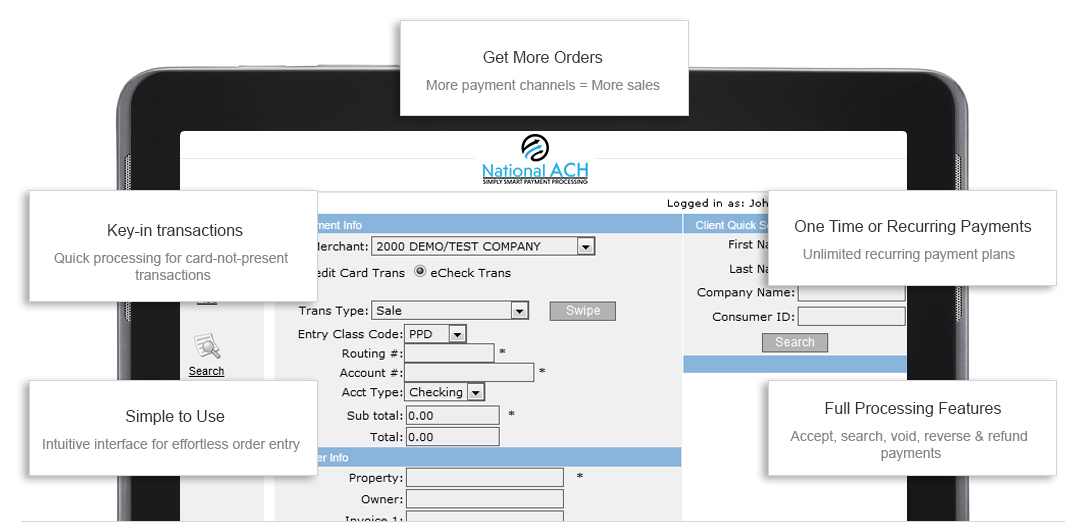

Searching for eCommerce payments so you can easily sell online? You’ve landed in the right spot. NationalACH provides online credit card processing & eCommerce payment methods to businesses in the US and worldwide.

- Low Rates. Contact us now for a no obligation rate comparison. Grow your business with low rates and top-notch technology.

- Fast Approvals. Rapid approvals quickly get you more sales.

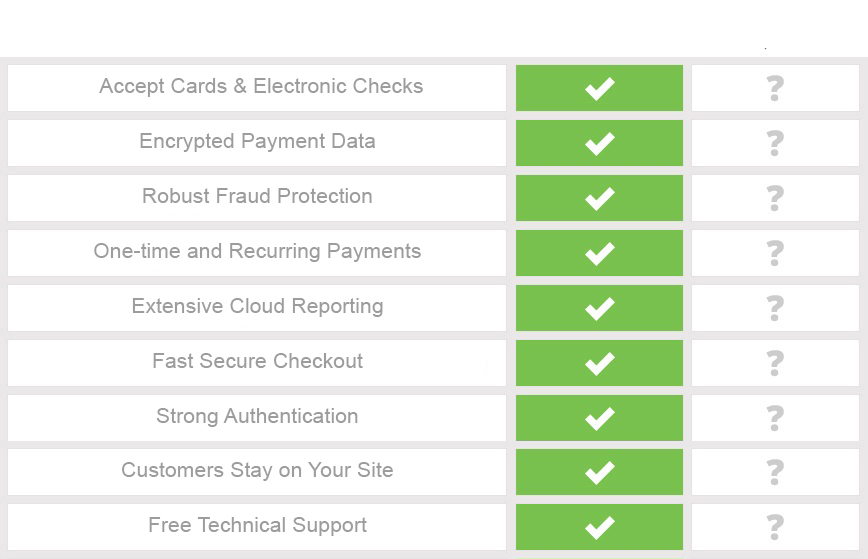

- Level 1 PCI-DSS Online Credit Card Processing Gateway. Military-grade security exceeds the most stringent standards for compliant eCommerce payment processing.

- Extensive Network of Banks. Get a single online credit card processing account. Or establish multiple eCommerce payment accounts to offset processing risk.

- Fraud Fighting Weapons. Protect your business and your customers.

- Chargeback Protection. Chargeback warning services help prevent chargebacks before they occur. Chargeback mitigation systems assist in fighting chargebacks you can win. Add 3D Secure to offload liability for some chargebacks back to the card brands.

- Superb Support. Experienced customer service representatives provide you the help you need when you need it.