In the Money Lending Business- Here’s What You Need To Know About Online Payments

Money lenders and loan servicing companies operate in trickiest part of the financial industry. Not everyone can handle the higher risks and volumes associated with a lending business.

Whether you offer car title loans or payday loans, you probably deal with a lot of regulation and inherent risk. To survive in the industry, your operations need be streamlined and completely efficient.

The best place to start is with the infrastructure that allows your customers to pay you. Studies show that traditional forms of payment are on their way out. Plastic is simply more convenient than paying with cash. And paying online, directly from your bank account, is even easier than paying with a card.

Convenience is Key

Loan service companies and loan providers face pressure from both sides – government regulations and customer defaults.

The local authorities and regulators are tightening the rules around lending, which puts pressure on loan companies.

Meanwhile, a study in Texas found that over the course of a year, more than 54% of borrowers defaulted on their payday loans. A similar study in North Dakota found that 46% of borrowers had defaulted on their loans after 48 months. Here are the findings from that study:

- To deal with this problem, loan companies must innovate and offer convenient solutions to help encourage payments from customers.

- Moving payments online has the dual benefit of allowing loan companies to get access to bank accounts and making it easier for customers to payback their loans.

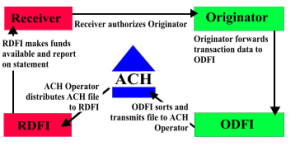

- The most convenient platform for online lenders and loan companies is Automated Clearing House or ACH.

ACH Payments

The reason ACH payments are so popular with loan companies is because it offers unparalleled convenience for both borrowers and lenders. ACH payments platforms allow the lender to automatically draw out the amount owed on a daily, weekly or monthly basis.

Borrowers who sign up for the service can have their dues paid automatically over the period of the loan. A writer for the New York Times found that this system of ACH payments encouraged borrowers to be more disciplined. Borrowers are put under pressure to manage their finance more carefully so that they can have enough money in the account to meet their living expenses and the automatic withdrawals from loan providers.

The infrastructure around ACH payments is designed for high volumes and regular payments. Some providers even offer services to let lenders get paid by checks over the phone, mail or fax, using a virtual terminal.

Convenience isn’t the only reason ach payments are better for loan providers. The payment platform is massive and the network handles close to 90% of all electronic payments in the United States. The ACH network is also considered to be among the safest and most secure electronic funds transfers system in the world.

A study by SAP found that automated payments through echecks are less prone to errors and fraud, since there is minimal human interference in the whole process.

Conclusion

ACH payments reduce costs, assure that payments are made on time, stablize revenue from recurring payments, and are safe & secure. This makes it the ideal payment solution for lenders and loan companies across the country.

Securing payments and offering convenience to customers will do more than just help your business survive. It will help your business thrive.

How are you accepting payments from your borrowers?

Contact us today