Benefits of Check 21 Remote Deposit Capture

Benefits of Check 21 Remote Deposit Capture (RDC) include:

- API software interface. Rolling out RDC is easy with quick integration with existing software.

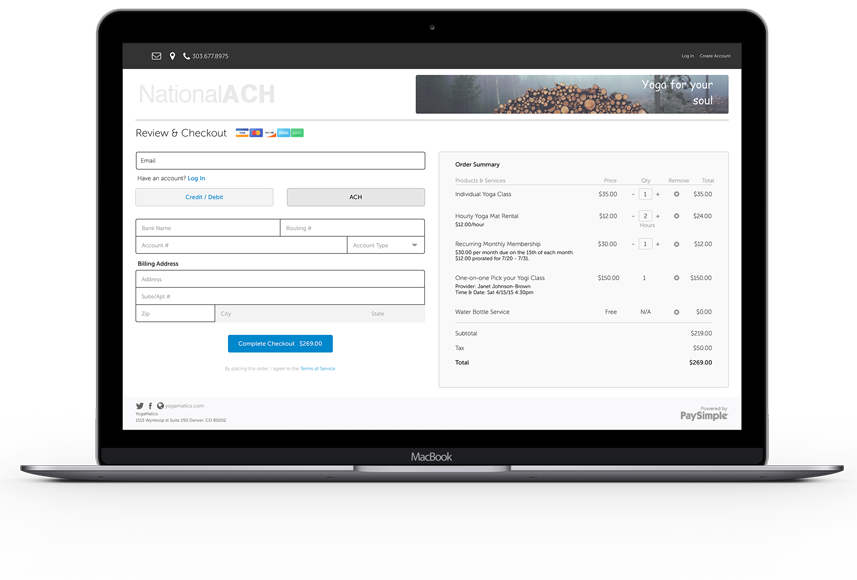

- Multi-function platform. Check 21-RDC, ACH, credit/debit card processing can all accommodated on the same platform.

- Banking independence. Customers can use any financial institution desired as a depository account for the ultimate in flexibility. No new bank accounts are required. If the customer wishes to change banks at any time, continuity of RDC clearing (and smooth operations for customers) is assured.

- Online check image archives. Easy search and retrieve for any image transaction. All checks are archived online for fast and easy access making it simple to recover and share any payment documentation to customers.

- Automated resubmission of returns. XML/SOAP eliminates the need for manual handling of returns increasing productivity and cash flow.

- Full online reporting. The entire clearing and settlement process for each transaction is available online. Management reports can be compiled quickly through the manipulation of any variables.

- Faster access to money. Remote Deposit Capture fosters speedy check clearing resulting in drastically decreased settlement times. Depending upon underwriting criteria of the customer, funds can settle to accounts as quickly as the next business day. Faster settlement means increased cash flow and quicker availability of working capital for your customers’ business.

- Reconciliation and management is infinitely easier. With RDC, checks are transmitted electronically eliminating the need for multiple depository accounts. Customers’ finance departments will no longer be burdened with the time consuming administrative functions required to manage multiple accounts. Consolidation also enables customers to take advantage of volume based transactions discounts and will save them money on account maintenance fees.

- Saves time and money. Electronic image transfer means fewer trips to the bank, saving transportation costs and eliminating courier and/or mail fees. And, since checks are archived online, there is no need to photocopy checks before taking them to the bank saving money on copying and storage.

- Increase productivity. Much of the error-prone manual labor of check preparation is eliminated with RDC, freeing customers’ employees to concentrate on other projects. Streamlining of check deposits management accelerates the smooth flow of your customers’ business operations.

- Expanded banking hours. RDC expands the banking hours in your day by 50%. In an amazing gift of time, RDC deposits can be made up to 8 pm EST freeing customers of worries about meeting a 4 pm cutoff time. Additionally, RDC offers convenient 24-hour deposit capability. Deposit checks anytime, including nights, weekends, and holidays; after hours checks clear the next banking day.

- Decreased fraud risk. RDC gives customers the protection of computerized anti-fraud programs which are not available with paper check transactions. Electronic clearing includes anti-fraud algorithms and systems for customer security. In addition, shorter clearing times offer better protection against check fraud.

- Clear file delivery. In the rare case where a poor quality image is received, customers receive notification via email. They can immediately resubmit the information assuring near 100% clear file delivery.

- Geography disappears. Flexible online reporting means data can be rapidly shared with customers’ management team, no matter where they are physically located.