Integrate Payments Increase Profits and Add Value to Your ISV Platform

The retail, kiosk, POS and e-commerce industries are expanding rapidly because of their embrace of new technologies. New marketing techniques, payment solutions, customer service tools, business intelligence, and other technologies combine to allow businesses to expand quickly.

Independent Software Vendors (ISV) now have to develop a wide range of software that enables businesses to do more with less. Considering the constantly developing economy and new payment solutions being introduced, ISV payment solutions have become crucial in the new financial environment.

- Value added service for your current customers. Highly desirable benefit help you obtain new customers.

- Offload payment processing security to the gateway, protecting you and your customers.

- Automated applications and underwriting for fast boarding.

- Payment processor provides all customer service. You make money with no additional work.

- Payment processing for US and international expanding your reach world-wide.

- Quick and easy way to take advantage of mobile commerce. According to a 2020 study, 63% of companies already offer mobile payments

ISV Payment Integration Solutions – What Does It Mean for Retail & E-commerce?

The idea of integrated payments means that as an ISV, you will embed payment processing systems into the software applications you provide your clients. This integrated payment solution will allow your clients and their customers to make payments within the ISV platform, instead of being redirected to an external platform or a third-party processing company.

Immediate benefits to you include:

- New income streams with no work. You share in the payment processing revenues.

- Private label payment gateway enhances the value of platform

- Value added service to offer your customers. Giving you a competitive edge in a crowded market.

- Private label payment processing gateway adds value to your brand. Includes robust reporting to access the details of your clients’ processing.

- Automated application for fast approvals and automated boarding of accounts.

Integrating payments enhances your integrated software infrastructure, which is particularly beneficial for today’s fast-paced world.

Importance of Integrated Payment Solutions for ISVs

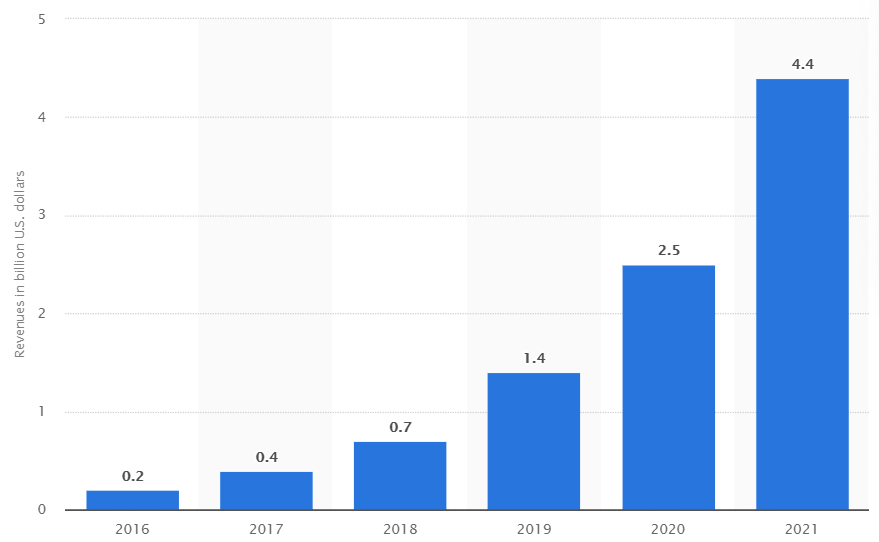

In the current financial climate, payment facilitators, such as PayPal, Square, and Stripe, are the primary mode of payment, particularly for global e-stores. The transaction fees herein were roughly $4.4 billion (revenue) in 2021, and this is expected to rise.

These are third-party facilitators that charge a fee every time a transaction is made through them. As an ISV, you can benefit your client by giving them an alternative; where they don’t have to part with a major chunk of their profit.

Among the clean code, embedded functionality, responsive design, and other value-added services you may offer your clients, embedded commerce might not be included but it should be. Clients seek increased satisfaction and increased revenue in a software solution.

Payment integration for independent software vendors is perhaps the best way to help clients achieve their financial goals and get on their good graces at the same time.

Benefits of Integrated Payment Solutions For

Integrated payment for ISV is a win-win for three parties at the same time: you (the ISV), your merchant (clients), and their customers.

Benefits to ISVs

- Better Adaptability

ISVs need to constantly stay up to date with the latest technological advancements in today’s ever-evolving economy. From accepting new payment methods to different currencies, especially cryptocurrencies, ISVs need to upgrade their system for better and quicker adaptability. Integrated payment providers for ISVs offer versatile solutions that consider new payment techniques, allowing you to offer solutions to a much broader market.

- Payment Gateway

The payment processing gateway can be private labeled for you, giving you an immediate competitive advantage. Automated applications and boarding for fast approvals, enhancing customer satisfaction.

The gateway includes multiple payment methods including:

- Debit / credit cards. Preferred payment method for US shoppers. Increasing popular world-wide

- Fast growing, in-demand payment option for all merchants including those classified as high risk.

- Mobile payments. The number of shoppers using mobile devices to pay is soaring.

- ACH for payments through bank accounts. Great for shoppers who don’t have cards, are maxed out on cards or simply prefer to pay with a bank account instead of a card.

- Digital wallets. Excellent processing option for higher risk merchants.

- Kiosks, Stand Alone Terminals, and POS systems. Payment processing with no human intervention is expanding rapidly in the US and Europe.

- Ability to Forecast Client Needs

We upgrade our integrated solutions constantly to allow ISVs to keep track of future client needs better. This way, ISVs can offer state-of-the-art solutions to their e-commerce and retail clients and frictionless integrated updates directly into the software.

- Value Added Service and Better Revenue Tracking

With payment solution integration into e-commerce, retail, kiosks, POS and stand alone terminals, ISVs can track incoming payments, disbursements, drawings, and expenses. This also helps you identify key partnership opportunities and boost business revenue in the process.

Through revenue sharing, e-commerce and retail ISVs also have the potential to earn a percentage of the transaction fees. The number of payment processing transactions is increasing with every passing year.

Money matters are still the most important element of any business. By offering better, integrated payment solutions to e-commerce and retail stores, you are adding value to your services. These value-added services go a long way in creating goodwill and forming long-term relationships.

As mentioned above, it also presents a chance to capitalize on a new revenue stream(s).

- Other Benefits

Other key benefits that you get through independent software vendor payment solutions include, but aren’t limited to:

- A better vertical market expertise, especially if you are developing ERP software that caters to every industry element, i.e., from customer service to order booking, content management supply chain, and post-delivery service.

- Better payment and data security. Through tokenization, sensitive payment and data elements can be protected in the e-commerce and/or retail system you would be working for, thus safeguarding payment and information.

- Become an all-in-one provider. If you are offering such an extensive payment integration service to your clients, expect a productive partnership as well.

Benefits of Integrated Payments for ISV’s Clients

The key benefits that your clients can get through ISV payment solutions include:

- An embedded, more streamlined business account management program

- Automatic transcription of transactions

- Automatic transaction handling and verification

- Increased business speed and payment efficiency

- Increased acceptance of payment models and currencies

- Improved cash flow, and, therefore, a better going concern. According to Business.com, 9 out of 10 businesses fail due to cash flow issues

- Better time management, and more.

- Better PCI compliance

This allows you and your clients the ability to charge and earn more.

Benefits of ISV Payment Integration for End Users

Finally, the benefits of payment solutions for your clients’ clients are:

- Better payment experience and, therefore, more inclined to buy

- Improved data and payment security as there are no third parties involved

- One-stop shopping for all of your clients’ needs, including payments.

- A more versatile portfolio of payment methods and currencies means ease of conversion.

Better Payment Integration For ISVs – Better e-commerce & Retail Experience

Integrated payments translate into a more streamlined retail, e-commerce payment processing, kiosks, and POS experience, effectively helping all parties involved. The transactions are quick, easy, and transparent, providing convenience to buyers and sellers.

Backed with the right sales, marketing, and management team, you can make the most out of ISV integrating payment solutions easily and improve your ROI across the board. Get in touch with us to see how you can add value to your clients as an ISV, accomplish your objectives better, and what it will take to get started.

Topics

- eCheck Payment Solutions for High-Risk Adult Entertainment Businesses

- eCheck Payment Solutions for High-Risk Travel and Ticketing Agencies

- eCheck Payment Processing in High-Risk Online Dating and Matchmaking

- eCheck Payment Processing for High-Risk Subscription Boxes and Membership Clubs

- Risk Management Tools for High-Risk ACH Payment Processing

- Optimizing Conversion Rates in High-Risk ACH Payment Processing

Categories

- ACH (96)

- ACH merchant account (62)

- ACH Network (14)

- ACH Payment Processing (91)

- ACH Unauthorized Return (2)

- Alternate Payment Processing (27)

- bank marijuana (1)

- chargeback prevention (1)

- Check 21 (29)

- Check 21 Payment Processing (11)

- check verification (3)

- check21 (4)

- Collection Agency Merchant Account (2)

- Crypto Merchant Account (1)

- Debt Collection Agency Merchant Acount (5)

- Echeck (53)

- echeck payment processing (46)

- Echecks High Risk Merchants (43)

- Ecommerce (2)

- ecommerce merchant account (3)

- electronic checks (51)

- Electronic Funds Transfer (12)

- Health Care Merchant Account (1)

- High Risk ACH (15)

- high risk merchant account (47)

- High Risk Merchants (34)

- High Risk Merchants (27)

- High Risk Payment Processing (52)

- High Risk Processing (37)

- International Payment Processing (4)

- Lenders Merchant Account (2)

- Moto Merchant Account (1)

- Nutraceutical Merchant Account (1)

- Payday Lenders Payment Processing (1)

- Payday Loan Processing (3)

- Recurring Billing (13)

- Recurring Payment (12)

- SaaS (1)

- same day ach (2)

- Secure Payment Processing (14)

- travel merchant account (1)

Popular blogs

- eCheck Payment Solutions for High-Risk Adult Entertainment Businesses

- eCheck Payment Solutions for High-Risk Travel and Ticketing Agencies

- eCheck Payment Processing in High-Risk Online Dating and Matchmaking

- eCheck Payment Processing for High-Risk Subscription Boxes and Membership Clubs

- Risk Management Tools for High-Risk ACH Payment Processing